A couple of weeks back, I opened the floor on LinkedIn for people to weigh in on 2023. There were definitely plenty of common threads and counter points. But before getting into the takes, let’s recap the restaurant landscape as another calendar flips over.

Without much debate, inflation dominated much of 2022, especially down the stretch. What’s interesting is where quick service might settle. Historically, people refer to fast food as recession-proof. Or, at the least, a recession-resilient sector. The reason being people have to eat. And if wallets tighten, dining out becomes an affordable luxury consumers are willing to invest in. More so, say, than a four-day weekend at Disney. Shaking this dynamic of late is also the reality grocery inflation has outstripped restaurants for months. The so-called “bridge meals” guests turn to restaurants for have become ever-prevalent. Is dining out really that much more expensive than loading up a grocery cart these days? It’s a complicated question.

MORE 2023 RESTAURANT TRENDS:

Restaurant Leaders See Tech, Value as 2023’s Biggest Trends

18 Predictions for the Future of Restaurants

20 Restaurant Leaders Share Their Predictions for 2023

22 Fast-Food Trends to Watch in 2023

Top 10 Restaurant Menu Items of 2022

What’s the Next Big Tech Trend for Restaurants? Here’s What the Experts Say

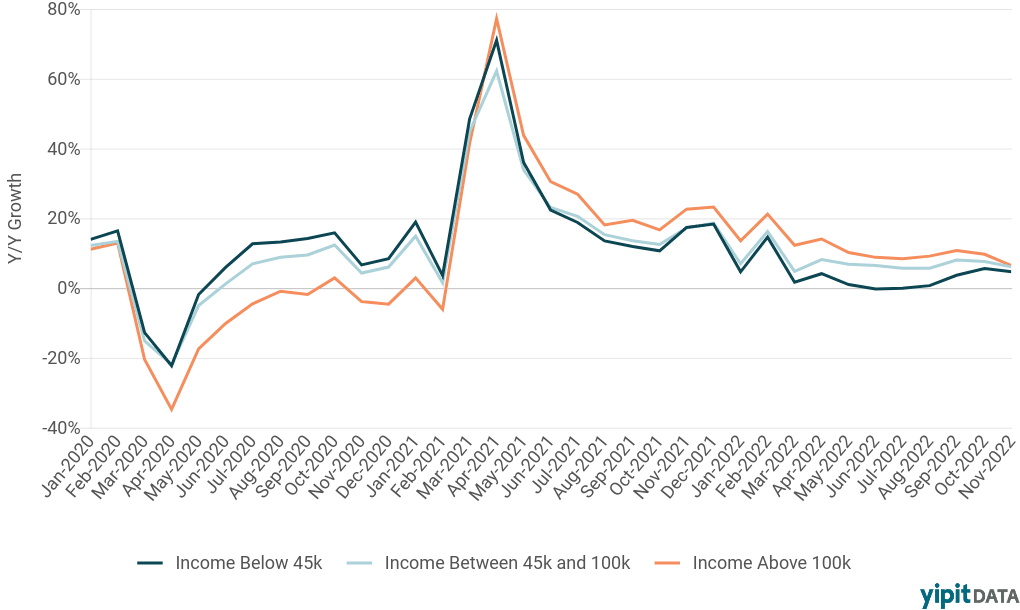

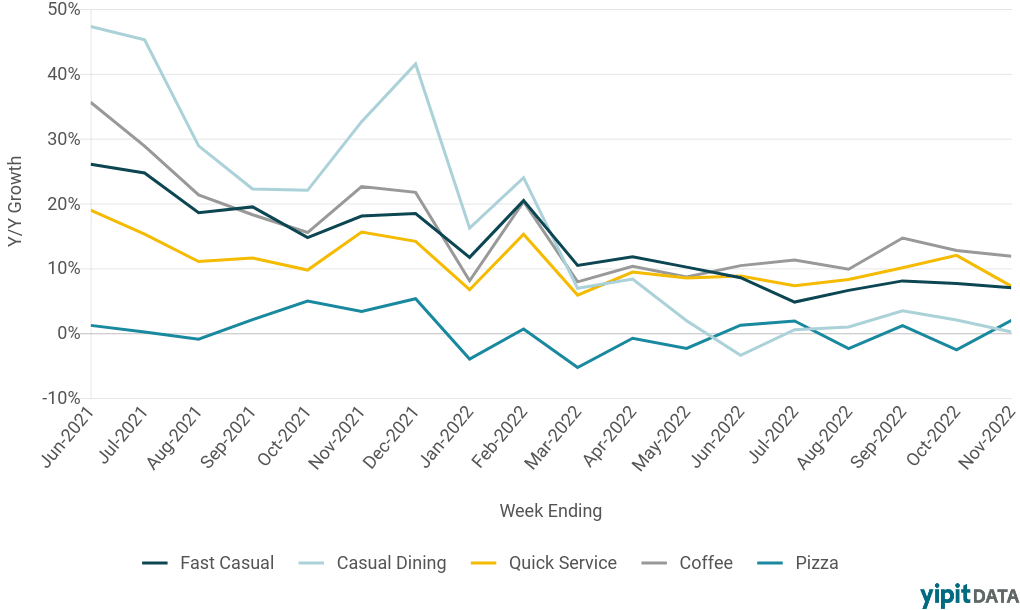

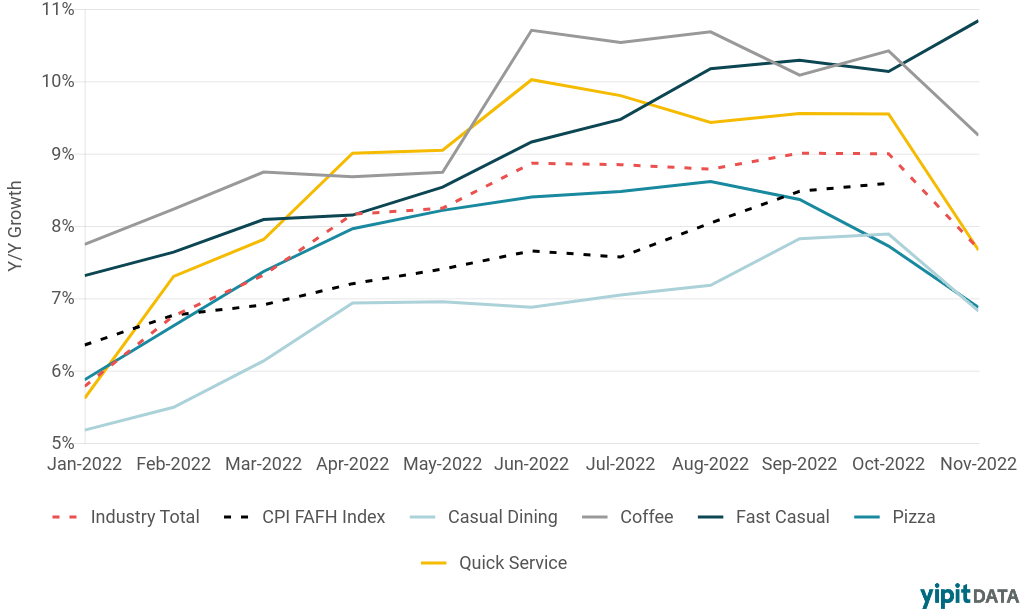

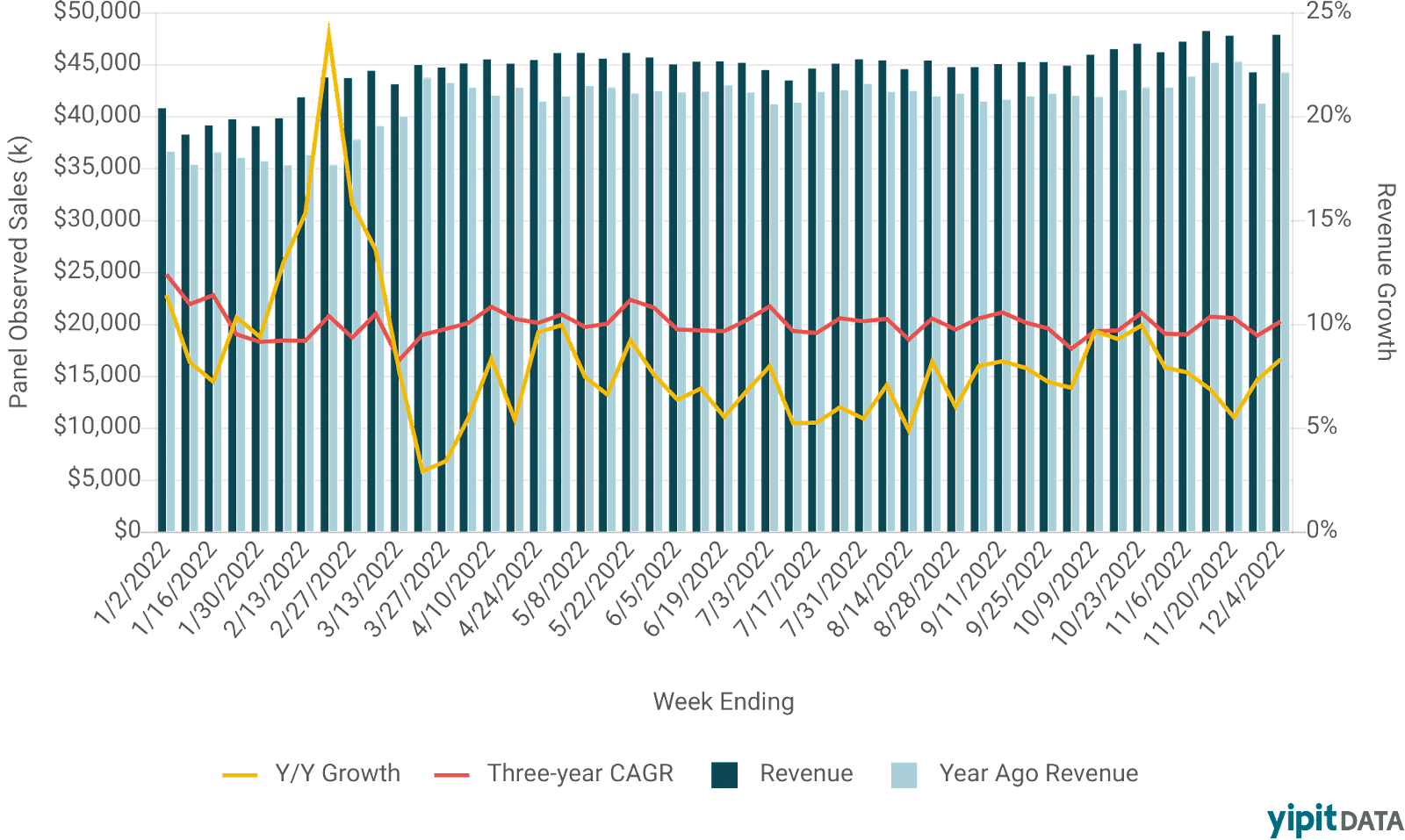

As the charts from YipitData below show, year-over-year restaurant sales growth decelerated throughout November, which broke a three-month accelerating trend. Quick service was the main driver. All industry segments, with the exception of fast casual, saw menu pricing decelerate year-over-year (the ceiling approaches, and, hopefully, commodity inflation peaked in 2022 and has stabilized somewhat).

There are a lot of factors at work; high level, it could be as simple as the typical seasonal downturn seen during this stretch across quick service. It might also be external forces competing for discretionary spending (gifts, travel, etc.) It’s hard to say, either way, how this portends into 2023 since the chart has fluctuated so much throughout the COVID recovery.

According to Baird reports, a November restaurant survey among private chains indicated November one-year comps at 3.5–4 percent positive versus 4.5 percent in October and 3.7 percent in Q4.

On a combined three-year basis, same-store sales growth for the sample was 16.5–17 percent above, more than October (14.5–15 percent). Q3 was up 14.8 percent largely due to improvement from fast casual. Broken down, fast casual was 11 percent higher; quick service 2–2.5 percent; casual dining down 3 percent; and “other” down 0.5–1 percent. Per the report, “outlook for 2023 remain[s] cloudy as the demand backdrop for restaurants could become more challenging than in 2022 due to tighter monetary policies leading to unemployment. However, more confidence is seen in limited-service chains [like franchised models] than in segments like casual dining, coffee.”

Revenue Management Solutions’ November dive showed quick-service traffic down 3 percent, year-over-year. That figure was negative 2.6 percent in October.

Net sales, meanwhile, remain plus 7.1 percent, year-over-year. In November, monthly average price did decrease slightly from the previous month (15.8 percent), mirroring YipitData’s findings. Still, though, price is up 15 percent. The top-line growth remains tied to price over traffic at this juncture, as well as the continual expansion of digital-channel revenue. Basket size dropped 4 percent in November, according to RMS. That might be a sign of inflation as guests watch their checks more closely.

In the company’s Q4 survey, three in four U.S. consumers said they believed they were paying higher restaurant prices (up from 68 percent in Q2 2022). In the same data, reported frequency declined across all segments and intention to dine was down an average of 6.5 percent across revenue channels.

For dayparts, dinner was slightly down and lunch was stable, but breakfast went the other way, with traffic nosediving from negative 1.8 percent, year-over-year, in October to negative 7.4 percent in November. It should be noted in November 2021 the daypart observed above-average increases (9.6 percent) as mobility returned. So this current view could be defined more as a stabilization than an alarming plunge. Year-over-year lunch traffic remained down 3.9 percent, year-over-year, but stable compared to the previous month (negative 3.8 percent). November dinner traffic was slightly below November 2021 (negative 0.8 percent), yet up from 1.2 percent in October.

To circle on the ensuring chart: drive-thru, despite being 10.2 percent lower, year-over-year, has held since May 2022. You’re looking at the future usage—elevated from pre-COVID, but not at 2021 levels. The culprit is a recalibration with dine-in, which gained 29.6 percent in November. That, too, has begun to calm. It was up 37.1 percent in October. Takeout was 20.6 percent better and delivery 11.5 percent. Both are declining a bit thanks to dine-in yet, like drive-thru, are sticking upward versus 2019.

Now, onto the user feedback.

The people part

Rachel Richal, VP, training, Buffalo Wild Wings

“A focus on simplifying process and re-training fundamentals to all levels. With the past few years full of constant change, high turnover, and quick promotions a focus is needed on core skills and behaviors required to execute quality operations and lead people.”

Sunny Ashman, VP of training, QSR Division, FAT Brands

“Investing in people—like REALLY investing in the leadership of the General Managers, Assistant Managers, and Shift leaders. Many of them are in those positions because they were really good at their job—not necessarily because they are good at LEADING people.”

Tripp Ferrer, senior manager kitchen equipment, Firehouse Subs

“Employment rates and recessionary impacts: a lot of technical indicators show signs of a recession but current unemployment rate is still low making staffing tough. If unemployment stays low staffing will remain hard however if unemployment increases it can hurt demand.”

Tammy Calhoun, director of learning and development, Firebirds Wood Fired Grill

“We have seen turnover like never before! I see a focus on training and simplifying processes.”

Sara Studer, leadership effectiveness, training innovation, talent strategy and design, Whataburger

“Connecting with today’s learner is mission critical to success in 2023! Those who continue to train the way they always have will struggle to meet goals with uninspired teams and high turnover.”

Katy Dean, COO, Buddy’s Pizza

“A renewed emphasis on employee experience and people-first cultural focus. It’s the best legitimate solution to the staffing shortage.”

Bryan Meredith, restaurateur coach

“When the Fed wins and unemployment goes up, the labor pool will get better for restaurants and the real decisions will have to be made with respect to staffing needs vs the path to automation. Restaurateurs must figure out this dynamic and get a clear focus on how they want to run their business.”

Kelly McCutcheon, VP of people, Hopdoddy Burger Bar

“Retention will rely on great training and development! With our industry’s turnover rates and doing all we can to keep doors open, training has not been delivered at our best. Those that train well and keep folks engaged through development will reap the rewards.”

Kaylor Hildenbrand, senior manager, innovation insights, Georgia-Pacific LLC

Hospitality, a renewed focus on the guest and employee experience, and more overtly positioning foodservice as a viable career path.

Growth pains?

Saul Cooperstein, chief strategy and development officer, VDC

“Unfortunately, I think in 2023 we see a tipping point where independents in urban centers are no longer able to sustain. I think this will be particularly dramatic in places like Los Angeles, NYC, Chicago, which have lagged significantly in their recovery from CV19. For example, in L.A., sales as of Q2 2022 were still below their pre-pandemic peak whereas the U.S. reached full recovery in August 2021 … traffic is down an estimated 13 percent since. NYC likely the same. These are also the markets where regulators have been particularly unforgiving. This will be particularly sad as I think it will cost us lots of amazing ethnic restaurants and cultural centers.”

Mark Hutchings, principal, Statement Insurance Agency

“I see a new wave of closures in the post pandemic era. PPP and other programs that kept struggling locations afloat during the pandemic are winding down just as a recession is starting. There will be a massive shake out. At the same time, surviving operators may finally see some labor relief as layoffs hit other industries and underperforming restaurants close.”

Chad Cohen, owner and creative leader, Seed PR and Communications

“I think you’re going to find more restaurants looking at alternative spaces. Not necessarily food trucks or mobile, but maybe not Main Street because the cost of rent is so high that the margins become unattainable.”

Into the tech bubble

Neil Thompson, VP, digital, HMSHost

“I see the future as dynamic speed of service. Flexible technology solutions that enable the guest to control the pace of their experience. For airport dining this is especially important, and I see benefits across the industry. [Quick-serves] have become more about convenience [DTs, third-party delivery) than as dine-in destinations. Expect this trend to continue and become even more specialized.”

Scott Marentay, VP of customer experience, Fingermark

“I see self-service evolving again this year, giving customers more control of their own experience. Voice, interactive visuals, mobile, computer vision, and loyalty will all play a role.”

Zak Bertram, senior sales executive, GRUBBRR

“Solutions that address the labor challenges that the restaurant world is continuing to face, such as self-ordering kiosks in the front of the house and automated cook stations in the back of house. The restaurants that leverage technology to best address the labor crisis will come out on top at the end of 2023.”

Hannah Vlk, brand operations manager, Orchard Culinary and Hospitality Group

“A huge gap I see in this industry’s media—the differing challenges and furthermore predictions between national chains and independent restaurants. Yes, technology is where $100M+ brands invest their roadmaps … but what about the <$10M independents in towns across America who can’t imagine a kiosk or robot in their restaurant? There’s a huge story to build there. I’ll start with what both arenas have to solve—making hourly staff give a crap about the big picture versus focus on the hustle and paycheck.”

Cliff Courtney, founder and principal, COURTNEY180

“QR code menus evolve from suboptimal PDFs to more intuitive designed GUI.”

Jeroen Rutten, CEO, Tablevive

“Delivery app commission seems to be the biggest challenge for SMB restaurants. A $30 order easily turns in to >$15 fees shared by customer and restaurant. They are all looking for an alternative. Like www.tablevibe.co: commission free direct to consumer delivery solutions saving restaurants >80% of the costs while delivering the same experience.”

Adam Golomb, president, CMO, Primanti Brothers

“Multiple virtual brand and ghost kitchen companies file bankruptcy and liquidate.”

Lane Davis, GM, Hawaiian Bros. Island Grill

“See an increase in ghost kitchens and digital kitchens. Strictly relying on mobile and third-party orders.”

Editor’s sidebar: I put these two side-by-side because it illustrates exactly what I’ve heard on this topic as well. It’s two forces of nature pulling in different directions with both hands. Eventually, it will follow the plight of so many trends before it—from opportunity to quality rising to the top, and a shakeout accordingly.

Lena Katz, lead, creator-integrated services, AOI Pro

“Could it be the convergence of AI/robotics and employees [fewer of them, perhaps better paid though] to improve guest experience while maintaining a sustainable profit margin?

I know, I annoyingly smooshed like six trends together but what I’m talking about is, for example, WhichWich having order kiosks that are manned by remote workers [for when customers presumably have a quick question or want to customize]. Or, Chipotle and others using TikTok to crowdsource innovation items.”

Brittany Maroney, director of marketing and communications, PAR Technology

“Maybe I am biased but I see more expansion for restaurants [quick service but particularly full service] into loyalty, using data to personalize and integration into online ordering and contactless payment.

[image source_ID=”127698″]

Culture speaks

Mark Moeller, restaurant consultant, The Recipe of Success

“Transparency—in all forms.

As a guest we want to know where our food is coming from, we want to know that the team is being treated fairly and ethically, we want to know if the restaurant owner is truly invested in the community they serve.

As an employee—does the owner and management believe in us and truly want the best for us. Will their words in the interview that got me hooked ring true, will they treat the guest fairly in all ways, will they pay us fairly and not skim off the top. Will they support us and train us to be the best ambassador for the concept.

For the investor (including banks—what research have you done, are your projections based on facts and not aspirations, do you understand your market, do you have a real marketing plan, is your concept sustainable, what is your true reason for opening this restaurant.

Restaurant operators have to come clean and go into 2023 with a real plan that includes being transparent to all those around and share approaches, dreams, and results (appropriately) and be ready to embrace success because they embrace transparency and practice it every day.”

Joseph Szala, managing director/account director, Pavone Marketing Group; managing director, Vigor

“Continuing to iterate and improve upon a gold standard customer experience including the internal stakeholder experience.”

Ops, menu opportunity, and optics

“To me, it’s still the tension of locations focusing on a quality experience versus locations that are speed. As quick-service and fast-casual prices continue to go up and quality seems to be hurting with labor more than ever the middle is getting squeezed even more. Innovation of the higher end for flavor and environment needs to accelerated at a much great pace. Predicting the middle mass chains will be eaten up by quick service and fast casual at a faster pace because they can’t differentiate with any of the key consumer purchase drivers equation of quality versus speed equals price willing to pay.”

Jeffery Cohen, SVP, ZEL Capital Partners

“Bulk purchase commitments for food and beverages to lock in pricing to prevent huge price fluctuations. Seafood restaurants often buy gigantic pallets in frozen storage of king crab legs, lock in a price, and invoice as needed.”

Liz Moskow, food futurist, principal, Bread & Circus

“Keeping visits up; as consumers are paying more for everything and racking up credit card debt, excessive spending has to be curbed. How do restaurants still provide value with higher prices and keep customers returning frequently?”

Charolette Browder, product development manager, Van Drunen Farms

“Elevated non-alcoholic offerings in terms of NA beers, wines, spirits, and cocktails.”

Brian Zeit, director of Sales, Kappus Company

“Comfort foods take the front seat as people start to begin to worry more and more.

Lifestyle eating becomes something of a once-thought-about due to scarcity and pricing increases, making way for the return of what makes us feel good and not necessarily healthier. Portion sizes shrink to keep up with inflation.”

Robert Crutchfield, editor, CrutchfieldCooks.com

“Continued narrowing of margins. You won’t be able to keep your eyes off your numbers. This will be more true than ever. That and if your numbers shift you’re going to have to be ready to pivot better and faster than ever.”

Zach Fetter, account executive, Fourth

“How do proprietors [SMB] keep up with continual increases in the cost of goods, without out pricing themselves out to keep a profit margin that can sustain the business?”

Megan Gibson, brands account executive, Restaurant365

“Improving margins starts with eliminating outdated systems that run your back office. Toss the excel spreadsheets!”

Gareth Walters, area director, international operations, Northern Europe and Africa, Focus Brands

“Could be wrong but seems to be a lot of strong momentum behind dynamic pricing.

Editor’s sidebar: Several people mentioned this. Adam Chain, founder of Muncho. Tara Jones, a GM at Shake Shack. It was given four hand-clapping emojis from Carl Orsbourn. I’d check out this series from Sherri Kimes to dive in.

Speaking of Carl, he offered two …

Carl Orsbourn, COO, Juicer, co-author of Delivering the Digital Restaurant

“1. Continued consolidation of tech providers. Too many choices, not enough differentiation between them.

2. Improved utilization of data to improve efficiencies in operations and enhancements in guest experience, which will become a critical differentiator as more and more restaurants improve their presence online.”