The price and value conversation remains a relative one for Chipotle, CEO Brian Niccol said. In the third quarter, announced Tuesday afternoon, the fast casual’s same-store sales rose 7.6 percent, year-over-year, as total revenue bumped 13.7 percent to $2.2 billion. How the comp broke down, however, illustrates a pressing reality. Chipotle’s 7.6 percent result comprised of 13 percent of price, negative mix of 4.4 percent, and a 1 percent decline in traffic.

Niccol admitted trends by income level have widened as pricing persists, with the lower-income consumer visiting less often. Yet given the landscape, namely grocery prices, which are outpacing restaurant inflation by some distance, Chipotle has also witnessed trade-down of higher-income guests into its business. Overall, it’s a matter of perspective, Niccol said.

Chipotle’s average chicken bowl, or burrito, which makes up roughly half of its U.S. orders, still sits below $9 in restaurants.

“Whether you look at it on a relative basis to what competitive pricing looks like or you look at it to alternatives, like with the grocery store; whether you look at it how new units are opening and how we’re performing on that front … we continue to demonstrate in all areas that the Chipotle brand is strong, and we continue to have a really strong value proposition,” Niccol said.

Chipotle’s menu pricing has increased from 8.5 percent in Q4 2021 to 13 percent this past period. Earlier in the month, it took a price lift in about 700 locations to address pockets of “outsized wage inflation” (the brand upped wages $1–$3 more than the country average to compete for talent). Menu prices in those stores hiked between 2–3 percent. So the pricing line will move from 13 percent to closer to 14.5 percent, approaching 15 percent, before dropping down to 11 percent in Q1 of 2023.

There’s a lot to unpack between the pricing lines for Chipotle. But to Niccol’s point, the chain entered this inflationary spike with arguably more pricing power than any large-scale brand in fast casual. In July, with Chipotle’s pricing running 20 percent higher than year-end 2020—about 4–5 times above normal, BTIG analyst Peter Saleh conducted a pricing survey across more than 25 cities. The result showed Chipotle, even after 10.5 percent greater pricing in Q1, was 10.7 and 9.2 percent cheaper than its largest national peers, QDOBA and Moe’s, respectively. Further, Saleh noted, Chipotle was 5 percent less than Baja Fresh, suggesting “Chipotle still has pricing power that it can lean on to support margins in this inflationary environment.”

Since 2018, per Saleh, QDOBA and Moe’s raised prices on chicken entrées by 21.5 and 28.1 percent. Chipotle, roughly 19 percent. Saleh’s assumption was Chipotle would continue to grab market share as it underpriced the competition—something it’s done for decades.

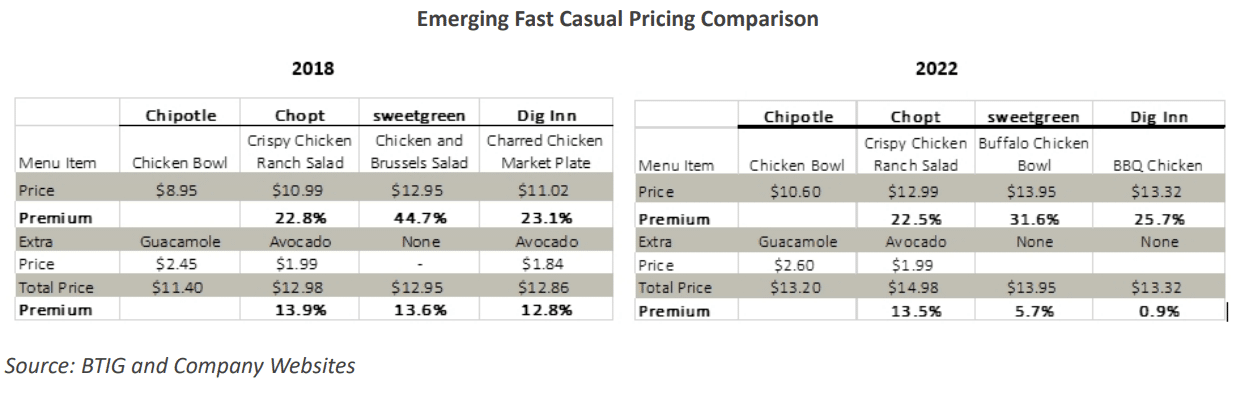

He also side-by-sided Chipotle with emerging fast casuals Chopt, sweetgreen, and Dig Inn. In competitive markets, Chipotle remained the lowest-cost outlet. Chopt had the greatest premium at 13.5 percent versus Chipotle, while Dig Inn was essentially in-line. Saleh also suggested Chipotle was relatively cheaper than Shake Shack with a value gap in the mid-to-high single-digit range. To note, however, Shake Shack only took 2.6 percent of pricing in 2021 compared to Chipotle’s 8.5 percent.

Niccol echoed this theme. “When you look at the fast-casual competitors, we’re anywhere from 10 to 20, 30 percent less than what you see on their menu,” he said. “So you’ve seen, unfortunately, in all this inflationary environment, everybody is taking price. Our costs, I think, are up over 20 percent over the last two years. Not surprising, other people are experiencing something similar and they’ve taken pricing accordingly.”

He noted ordering behavior hasn’t adjusted, either. While lower-income guests might be coming less often, core users are ordering Chipotle just as they always have. “We’re not seeing people all of a sudden not buying guacamole or changing what they typically add to their order or switching between proteins,” Niccol said.

The mix change came from group size. In-restaurant sales jumped 22.1 percent in the quarter, with digital representing 37.2 percent of the business, down from 41.9 percent in Q1 and 39 percent in Q2.

What Chipotle observed was more solo visits, or people paying for their own meals in groups. Chipotle is selling fewer burritos per transaction. More dine-in business has fueled the dynamic as digital orders tend to carry larger checks as well. Delivery was down in the quarter to 18 percent of sales.

But returning to the broader headline, Chipotle’s two- and three-year stacked traffic figures of 7.5 and 9 percent in Q3, respectively, back Saleh’s outlook—Chipotle has gained share despite softening guest counts, which have been an industry-wide reaction during inflation.

The most meaningful change in Q3, Saleh said, concerned commodities and how they appear to be stabilizing after more than a year of outsized inflation. Executives on Tuesday indicated that while beef, cooking oil, and tortillas were still experiencing higher prices, other items, including chicken, paper and packaging, and dairy, have begun to moderate. Commodity prices rocketed about 20 percent over the past year for Chipotle (offset entirely by the double-digit menu pricing).

READ MORE: AI and Machine Learning Enter the Kitchen at Chipotle

So if commodity costs move from stable—where they sit today—to deflationary in coming quarters, Chipotle could be in line for “several hundred basis points of margin expansion,” Saleh said. Every 10 basis points of change in food costs, he added, equates to about 26 cents in annual EPS. Forward estimates might rise several dollars if deflation does, indeed, occur.

All of these realities, and hopefully a more normalized labor environment, should send Chipotle’s pricing to historical norms of 2–3 percent next year. Over the past nine quarters, Chipotle posted five periods of double-digit same-store sales, three of high-single-digit growth, and one in the mid-single range.

It’s likely the future holds closer to that latter view, but with less pressure on margins.

Again, however, Chipotle’s tight rope is a work-in-motion. Can it use price as a tool to guard margin and yet not also threaten the affordability positioning that’s, thus far, stayed mostly intact?

“The way we’re trying to balance this is really only use price as the last lever to pull,” Niccol said. “And I think that’s what we’ve done throughout the course of the last, call it, two years because we like having the strong value proposition, frankly. I like being in the position where we have the best culinary with the best ingredients and arguably the best price. And so, it’s a position of strength and it’s a position we want to hang on to as we go forward.”

Niccol noted there’s no side-stepping reality. Everybody is forced to pull the pricing lever. What’s important, though, is to look at how your pricing stacks up relative to people’s alternatives. Those being grocers or other restaurants.

And Niccol feels Chipotle hasn’t ceded ground.

The chain opened 43 new restaurants in Q3, including 38 with a pickup window “Chipotlane.” It’s on track to open 235–250 units this fiscal calendar, including 10–15 relocations to add a Chipotlane.

Niccol said new units are achieving 80–85 percent of what typical mature units do. One in a small Texas town (lower-population markets are a focus for Chipotle’s development) set an opening-day record.

“So I think that tells me we’re getting signals in all different fronts that our value proposition remains really strong whether it’s a new restaurant coming to an area or an existing restaurant competing in an area that we’ve been competing in for a while, Niccol said. “That’s the needle we’re trying to thread.”

“Value” is a metric with angles these days. If customers are paying more for daily staples, from food to gas, brands have to deliver beyond the price point. It’s as much about providing an experience worth the cost as it is racing to the bottom.

How Niccol described the equation for Chipotle: “This is a tremendous value when you consider the quality of our food, including our food with integrity standards, the fresh preparation utilizing classic cooking techniques, the customization, generous portions and of course, the convenience and speed.”

Employees begin prep at 7:30 each morning to deliver against these traits. But achieving consistency on “being brilliant at the basics,” as Niccol put it, has been a challenge. Chipotle’s hourly turnover climbed near 200 percent last year.

At the end of last quarter, the brand rolled an updated program called “Project Square One,” which includes training around throughput, digital execution, food quality, and hospitality. “We’ve made some progress during the quarter,” Niccol said, “but we are not where we need to be. The capabilities of our teams needs to, and will, improve.”

In uncertain times, he said, Chipotle is rallying around a North Star of “treasuring the guest,” which will be the primary focus of “everyone in operations and across our company.”

Highest-volume stores are meaningfully outperforming those on the lower end of the slide, in terms of throughput. And one thing they have in common? Experienced managers, Niccol said.

Since January, about half of field leaders are new to the role at Chipotle (90 percent are promoted internally). There are simply a lot of employees company-wide, new or fresh to their roles, who are learning on the go. “That’s what Project Square One’s all about is making sure if you’re a newly promoted field leader, you know how to do the job. You’re newly promoted general manager, you know how to do the job. Maybe you’re new to our company all together at the crew level, you know how to do the job,” Niccol said.

“And over the last two or three years, we’ve had to flex based on different regulations coming at us for how we wanted to run the restaurants,” he added. “Now we’re getting back to what we believe is the right way to run a Chipotle in an environment that allows us to execute our standards, our processes, and our culinary. And so, there’s still opportunity for us to get better at it because the teams need more reps. But I think we’re also surrounding them now with, I think, clarity on what the standards are as well as tools to give them clarity on how they’re performing real time.”

Project Square One, as the name explains, aims to reestablish the processes and standards that existed before surviving a pandemic became the front page of the playbook.

Niccol said Chipotle has ramped up communication efforts between leaders and hourly crew. Through feedback, it’s discovered front-line employees want more educational benefits (which led to the debt-free degree program) as well as career certificates. Employees who have participated in Chipotle’s educational programs are twice as likely to be retained and six times more likely to be promoted, Niccol added.

As this unfolds, Chipotle will invest in back-end tools to improve connectivity and experience. One is advanced location-based technology that enhances the brand’s app functionality. For guests who opt in, the program engages with users upon arrival and uses real-time data to present features like order-readiness messaging, wrong pickup location detection, and reminders to scan the Chipotle Rewards QR code at checkout.

Growth, branding, and LTOs

Following its planned 235–250 locations this year, Chipotle expects to ramp up to 255–285 new openings in 2023, which would get it to the high-end of a previously laid-out target of 8–10 percent growth en route to 7,000 locations.

As Chipotle expands core markets, it’s also looking into fresh avenues, including Alberta, Canada, and the aforementioned small U.S. towns. The Alberta unit will mark Chipotle’s first Calgary store, with more on deck.

The small-town strategy in particular, which Chipotle brought up in February, has turned in comparable margins and returns to the company average, Niccol said. Given the generally lower fixed costs, it’s proven a desirable entry point Chipotle plans to keep leveraging, especially given the real estate agility. The brand expects 80 percent of its go-forward growth to include Chipotlanes. Urban units are outperforming non-urban ones, but are still below 2019 levels.

Development delays are a headwind, though, CFO Jack Hartung said, including equipment and construction material shortages, construction labor challenges as well as permitting, utilities, and inspection delays.

Before COVID, from the time Chipotle saw the site to negotiations to opening, the chain was looking at about 14 to 15 months. Now, it’s more like 20–22 months, Hartung said.

“So the biggest challenge we’ve had is, frankly, supply. I mean, if it’s components, for example, for a walk-in cooler or the HVAC, you can’t get the restaurant open,” he said. “There’s just no chance of doing that.”

“If we see some easing in the supply chain for the materials and the components that we need for the restaurant that all by itself could knock off a couple of months,” he added. “But then there’s also construction labor. There’s also permitting.”

On the branding front, Chipotle continues to expand its Real Food for Real Athletes platform that includes curated bowls for digital orders. Locally, it teamed with college athletes in Ohio for a campaign to go alongside its “88 Club” spot (a nod to Dallas Cowboys wide receivers who’ve worn the jersey number) that premiered nationally during Sunday Night Football.

Chipotle is sticking to its cadence of one to two LTOs a year as well. Garlic Guajillo Steak has been live since mid-September. It was introduced to Chipotle’s Roblox community in the metaverse. Users could grill, season, cut, and virtually “taste” the steak. The first 100,000 who successfully did so received a promotional code to be redeemed in-store. Chipotle also provided early access to its more than 30-million-member rewards program.

Following Pollo Asado, Chipotle started testing Chicken Al Pastor in Denver and Indianapolis. If successful, the product could launch in 2023