Shake Shack is preparing for a digital revolution, and it’s beginning by building a solid, virtual foundation.

To say the channel exploded this year would be an understatement. In March, digital sales mixed 23 percent, but after mass dining closures in the spring, the business grew to 81 percent in May. In the final six months of 2020, the channel settled at 59–62 percent. In Q4 specifically, app/web sales increased 3.5x year-over-year, and the company retained more than 90 percent of the digital high point in May. Shake Shack managed to gain 1.8 million first-time app/web purchasers since early March.

“With dining room restrictions still in place to quite a significant degree across the system, these digital products remain really critical to our ability to continue to operate, continue to serve our guests, and continue to deliver this forward and improving momentum that we’re seeing in our sales numbers,” CFO Tara Comonte said Tuesday during this year’s ICR Conference.

A key tenet of Shake Shack’s digital foundation is launching innovative ordering experiences.

The brand rolled out curbside pickup in July, which is now in place at roughly 70 stores, primarily in suburban markets with enough parking. About 150,000 unique consumers have used curbside since its launch six months ago, and 30 percent of that have been new guests. Shake Shack has found curbside brings a higher average check and elicits positive feedback from consumers because of the convenience and safety aspects, the company said.

To further enhance off-premises, Shake Shack is currently testing delivery through its mobile app at three Miami stores. The technology enables geo-location and real-time map-based order tracking, ownership of transaction and guest relationship data, price testing and differentiation from third parties, and the opportunity for personalized messaging. Shake Shack expects a full systemwide rollout through Q1 and Q2.

THE COVID-19 ROAD FOR SHAKE SHACK SO FAR

Shake Shack Paid Employees Nearly $6 Million More in 2020

Shake Shack’s Growth Refuses to Take a Back Seat to COVID

How Shake Shack Leveraged IGTV to Reach Customers

Shake Shack’s Curbside Footprint Expands

Shake Shack to Grant Employees Year-End Bonuses

Shake Shack is Back on the Growth Path

Shake Shack Turns to Pickup Windows in Pandemic Squeeze

Shake Shack Returns its $10 Million PPP Loan

Sales Plummet as Much as 90 Percent at Shake Shack

Shake Shack’s Dining Rooms Close Amid Coronavirus Spread

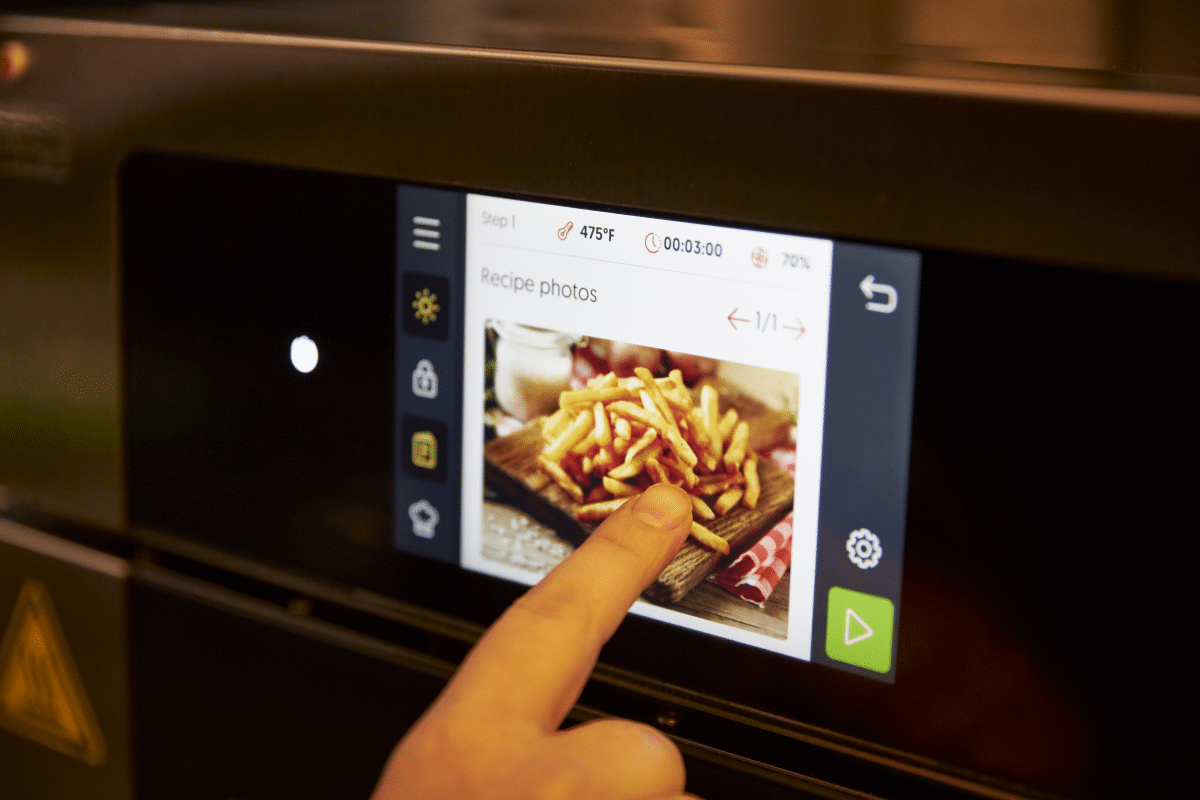

Additionally, Shake Shack is in the process of fully rebuilding its website and mobile app, both of which should launch in the latter part of 2021. The purpose of the update is to create a more visually pleasing and engaging experience, especially when it comes to ordering capability. Comonte said the reimagined web/app will allow for new merchandising opportunities, improved cross-sell and upsell, and integration with Shack Track, the brand’s innovative pickup ordering process.

“We’re in a moment where all this digital infrastructure or these digital investments are really beginning to be fully integrated into that physical experience, and that’s a really key piece of that journey,” Comonte said. “So all the Shack Track opportunities, the different digital pre-order and pickup options that guests will have, will be fully within our web as well as white label delivery.”

Along with these upgraded digital channels will come new, contactless forms of payment, including Google Pay, Apple Pay, and digital gift cards. This not only allows Shake Shack to link purchase behavior across in-store POS and digital channels, but it also strengthens security and privacy management.

From a business perspective, Shake Shack is able to take the informative data learnings from these amplified channels and improve marketing efficiency, deliver insights that feed into growth strategies, and target unique segments.

For example, Shake Shack will have the ability to reactivate specific users within a to-the-mile radius of specific stores and send timely messages to users that are most likely to purchase.

“The point being, we can communicate with our guests or we will be increasingly able to communicate with our guests on a much more granular level, a much more insightful, a much more relevant level, than we typically have in the past,” Comonte said. “And also identify those segments depending on where they are within the overall purchase lifecycle, whether we talk differently to guests we’re trying to acquire versus guests that we’re trying to reengage and drive frequency and engagement or a lapsed guest that we’re trying to reactivate.”

Expansion and store models

Another foundational part of Shake Shack’s evolution is building proper infrastructure to support digital growth.

The chain opened 20 stores in 2020 despite COVID-19, including No. 300. The brand expects to open 35 to 40 stores in 2021 and 45 to 50 in 2022, with targeted openings in both urban and suburban markets. Shake Shack is setting a goal to reach company-operated unit growth of roughly 45 percent in the next two years, which would see its corporate footprint rise from 183 to between 262 and 272 in 2022.

As CEO Randy Garutti explained, Shake Shack has proven its concept in free standing pads, urban centers, food courts, and shopping centers. But with digital now at the forefront, Garutti said it’s now time to show Shack Shack can win with walkup windows, drive-up windows, drive-thrus, and small, digitally focused stores.

At the crux of this is Shack Track, which will be incorporated into new stores, with more than half of the 2021 class utilizing either curbside, walkup, or drive-up.

“It really is our enhanced digital order pickup solution,” Garutti said. “The goal is to reduce that friction. We know that Shake Shack has always had friction in the order and pickup experience, especially.”

Shake Shack’s first drive-thru will open in Orlando; five to eight are scheduled to open across the U.S. by 2022. Garutti said the brand has a lot to learn about drive-thru, but that it’s committed to that learning. One of the goals is to not only provide convenience, but to attract consumers to the dine-in experience.

“It’s not just a box where you go around and get your food,” Garutti said. “But for those times I need that convenience, it’s there.”

Eight walkup windows—both new and conversions—opened in 2020, and more are planned for this year. One Colorado store even includes a separate entrance and vestibule area for digital and delivery pickup. In addition, last year a Shack Shack in Vernon Hills, Illinois, was converted into the first drive-up window store. About five more are planned for 2021, including one in Danbury, Connecticut. Shake Shack is also planning urban-based digital stores that have small interiors to decrease investment costs, but also experiential outside dining.

Although Shake Shack is moving ahead with the innovative designs, that’s not to say Shake Shack still doesn’t believe in its flagship design.

“Our core that built this company is great experience,” Garrutti says. “We’re going to continue to do that more than ever.”

Shake Shack opened 23 licensed stores last year, including a 35 percent increase in the Asian market. Fifteen to 20 licensed Shacks are planned for this year and 20 to 25 are expected in 2022; the growth will focus mostly on Asia. Currently, there are 128 licensed stores—106 of them outside the U.S.—and the company wants to see 163 to 173 by 2022.

The company sees the best potential in China, where there’s seven stores open and three development agreements in place for the Mainland.

“We’re still a relatively small company,” Garrutti says. “To have this global impact, to have this love and appreciation for the brand in so many places, is exciting and just shows the whitespace.”

“I think it’s going to be a tough winter. For the country, for all of us, there’s reality that we have to deal with,” Shake Shack CEO Garutti said.

Store recovery

Similar to what’s been seen across the industry, Shake Shack’s suburban units are recovering faster than urban stores that have greatly missed foot traffic and occupied office spaces.

Overall, comp sales dropped 17.4 percent in Q4, after slipping 31.7 percent in the third quarter. For the fiscal year, same-store sales decreased 27.8 percent.

Same-store sales at suburban stores were flat in Q4, compared to a drop of 16 percent in Q3 and a decline of 38 percent in Q3. Urban locations decreased 31 percent in Q4, after sliding 43 percent in Q3 and 57 percent in Q2.

Here’s how Shake Shack’s recovery breaks out by region from Q2 to Q4:

Northeast

- Q2: –41 percent

- Q3: –18 percent

- Q4: –4 percent

Southeast

- Q2: –41 percent

- Q3: –25 percent

- Q4: –6 percent

West

- Q2: –45 percent

- Q3: –30 percent

- Q4: –17 percent

Midwest

- Q2: –47 percent

- Q3: –36 percent

- Q4: –19 percent

NYC

- Q2: –64 percent

- Q3: –49 percent

- Q4: –38 percent

Manhattan

- Q2: –69 percent

- Q3: –60 percent

- Q4: –49 percent

And here are how the average weekly sales trended in the fourth quarter:

(Dollar amounts in thousands)

October

- Average weekly sales: $62

- Total year-over-year sales growth: –5 percent

- Same-store sales: –21 percent

November

- Average weekly sales: $62

- Total year-over-year sales growth: –3 percent

- Same-store sales: –17 percent

December

- Average weekly sales: $62

- Total year-over-year sales growth: –1 percent

- Same-store sales: –15 percent

As for the menu, Shake Shack began the year with the Shackmeister burger, but then paused and pulled back all LTOs and removed complicated and low-selling items. Then it returned with its Hot Chick’n program and recently debuted its Korean Style Fried Chick’n sandwich along with Korean Gochujang fries. Garutti said this year, Shake Shack will seek innovation in the cold beverage category and continue to leverage culinary relationships to concoct chef-inspired products. Additionally, the brand is testing various vegetarian options, including the Veggie Shack, in about 30 stores.

“I think it’s going to be a tough winter. For the country, for all of us, there’s reality that we have to deal with,” Garutti said. “We have dealt with that for the last 10 months. … But the word I use around my family and around this company is hope. We believe in what’s ahead. We believe that there will be a pent-up demand for experiences, great food, travel, and the kind of places where people gather, and that is what this company has been built on.”